Understanding CRA Reform

An overview and comparison of the Federal Reserve’s CRA ANPR and the OCC’s final ruling

Since its enactment in 1977, the Community Reinvestment Act (CRA) has been an important tool in addressing redlining and the lack of investments in low- to middle-income (LMI) communities. It requires banks to meet the lending needs of their community, including credit-worthy LMI individuals and minority-owned businesses. However, it has failed to keep pace with today’s evolving banking environment or improve credit accessibility for those it was designed to protect.

It’s been more than 25 years since the last revisions to the CRA, and during that time mobile and digital banking has grown in popularity without being addressed in CRA requirements. In addition, the gap between black and white home ownership is 3% greater than it was in 1960.1 It’s clear that the CRA needs to be revisited and updated. This article will compare and contrast the OCC’s and the Fed’s efforts to strengthen and modernize existing CRA requirements.

The Office of the Comptroller of the Currency

The OCC released an Advanced Notice of Proposed Rulemaking in August 2018. The FDIC joined the OCC and released a joint Notice of Proposed Rulemaking in December 2019 and opened the floor to stakeholder comments to help inform and guide the final ruling. Citing the need to focus on issues related to the 2020 COVID-19 pandemic, the FDIC removed themselves from the rulemaking process. In May 2020, the OCC released their final ruling, which includes, but is not limited to:

- Clearly enumerating CRA qualifying activities

- Defining assessment areas

- Establishing performance standards

- Establishing data collection and retention requirements

While the final rule went into effect on October 1, 2020, banks subject to general, wholesale and limited performance standards have until January 1, 2023 to comply. Intermediate and small banks must comply with the ruling by January 1, 2024.

The Federal Reserve

In September 2020, the Fed released an ANPR on updating their CRA regulations with a 120-day comment period ending February 16, 2021. Stakeholders “have expressed strong support for the agencies to work together to modernize CRA.”2 Stakeholders were asked for feedback regarding the Fed’s efforts to:

- Bring greater clarity, consistency, and transparency to performance evaluations

- Minimize data collection and reporting burden

- Base performance evaluations on bank size, business models and local conditions

- Clarify and expand eligible CRA activities in LMI communities

- Recognize the special circumstances of small banks in rural areas

Their intent is to ensure LMI banking needs are met, promote financial inclusion and address changes in the banking industry over the past 25 years.

How they differ.

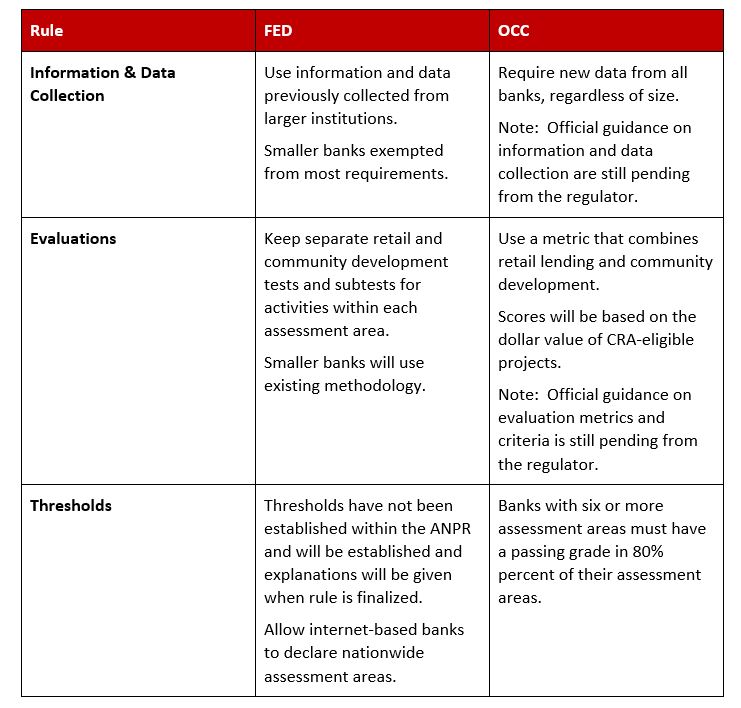

Both reform efforts seek to align CRA requirements and reporting with today’s banking needs, from modernizing assessment areas to clarifying eligible activities for CRA credit. However, the approaches differ in a few areas.

While the OCC rule was finalized, the FED ANPR is still accepting comments. Pundits believe there is still time for the agencies to come together to provide uniform regulations, as stakeholders across the board have requested.

Be ready for your next CRA examination.

Understanding updated CRA requirements, from whichever regulatory body you report to, is essential to receive the CRA credit your bank has earned. At Marquis, we’ve kept and continue to keep our finger on the pulse of the CRA modernization process. When it becomes time to implement new CRA regulations, Marquis compliance experts will be ready. Marquis has a proven history of helping clients tell their CRA story.

“Our recent CRA Exam was truly a team effort, involving our Production Officers, CFO, Investment Officer, CRA Committee and some invaluable help from Marquis,” says Roger McLaren, Vice President, Inwood National Bank. “With CRA, like in life, you have to keep score, tell your story and pat yourself on the back. In the end, it comes down to solid record-keeping. Between our efforts, Marquis Software’s ability to sort and organize our data, and assistance from Marquis Compliance Professional Services, we were able to assemble the data we needed, analyze the results, and verify our success. It all culminated in an Outstanding CRA Exam rating.”

Contact us at [email protected] to see how Marquis is addressing this much-needed change to the CRA and how it affects your institution.

1 Urban Institute, Reducing the Racial Homeownership Gap https://www.urban.org/policy-centers/housing-finance-policy-center/projects/reducing-racial-homeownership-gap

2 Federal Reserve, Fact Sheet on the Community Reinvestment Act, Advanced Notice of Proposed Rulemaking, September 2020 https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20200921a1.pdf